Envelope Budgeting: How it works (and can benefit you)

The traditional envelope budgeting system uses a budget binder or a box with envelopes to store paper bills. Each envelope is designated for a specific expense or savings goal—rent, entertainment, vacation, bills, etc.

How Does the Envelope Budgeting System Work?

Envelope budgeting helps you keep track of both income and expenses. The idea behind an envelope budget system is pretty straightforward—traditionally it’s based on cash—a paycheck is cashed and divided up into a variety of cash envelope categories. Whenever money is needed for a particular cost, the necessary amount is taken out of the appropriate envelope.

Once the budget envelopes are empty, that’s it, the limit is reached and there's no more money to spend—you either don’t make any more purchases or you have to borrow from another category. This motivates the idea of keeping to a budget by helping you visualize the money you’re spending/receiving and holding you accountable for breaking the budget. Also, with the cash envelope system, there’s no way to be in the negative.

Digital Envelope System

While the cash-only approach can be beneficial, it has some pretty obvious drawbacks— leaving hundreds or perhaps thousands of dollars around your house to use for budgeting isn’t the safest method for storing your money. Similarly, relying on cash as your main spending method can be inconvenient.

A digital cash envelope system is safer and can be created with your bank or an app. This could mean putting your money into multiple bank accounts, only using certain cards for certain expenses, or dividing it up in a spreadsheet or other method.

Cash Envelope System vs. Digital Envelope System: A hybrid Approach

Often times, people find using a hybrid approach makes the most sense. While it’s not practical to use cash for an entire budget, it does make you less likely to spend frivolously or avoid those impulse checkout purchases. If looking to cut spending in particular areas, like your grocery bill and entertainment, you can use cash envelopes for those categories and digital envelopes for everything else. Once you’ve calculated your budget, you should experiment to see which system works best depending on your habits. Each system works—the efficiency of each just differs from person to person.

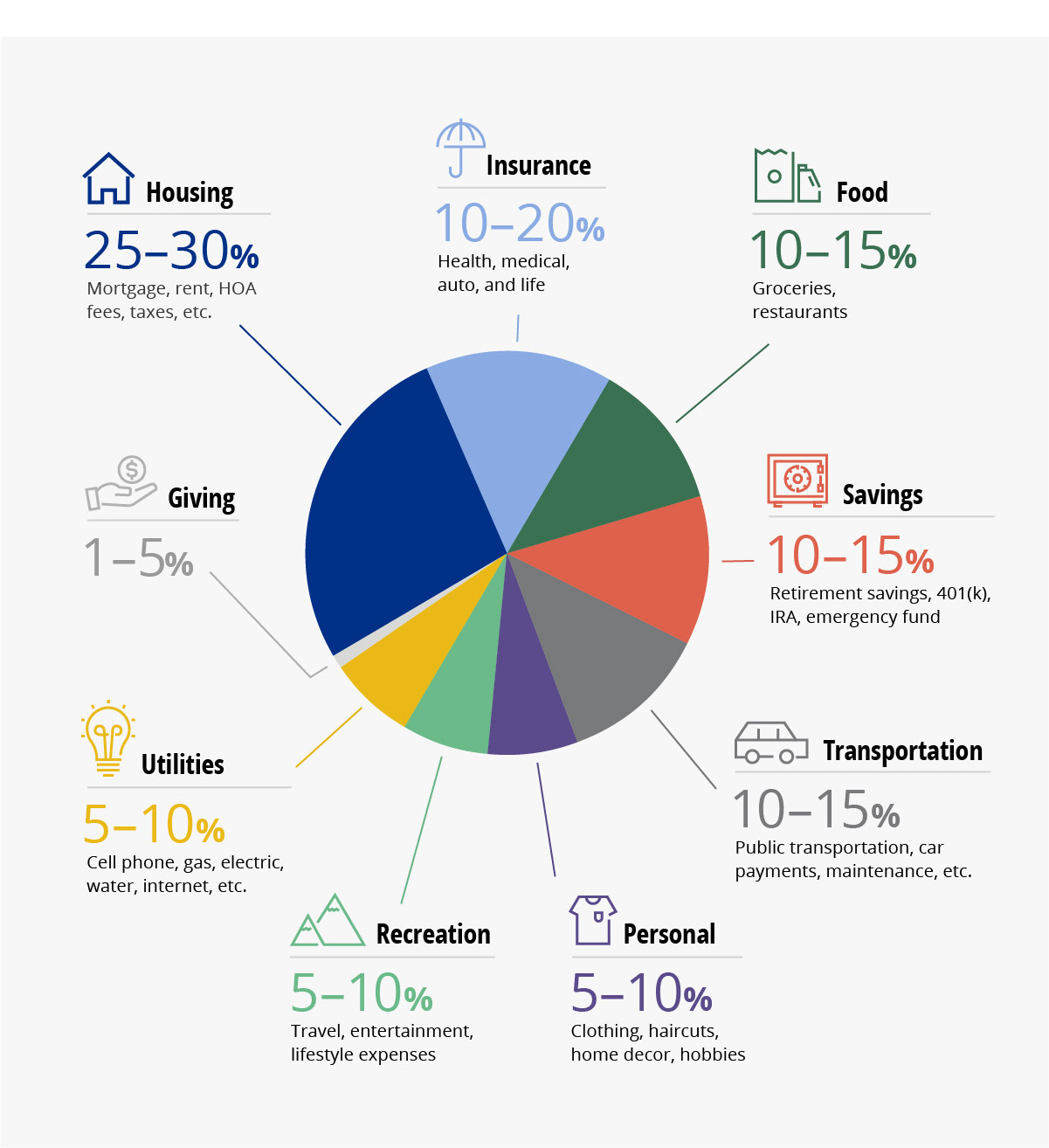

What Envelope System Categories Should I Use?

The only way to know which envelope categories are best for you is to analyze your expenses, organize those expenses into specific groupings, and create a budget . Use the groupings found while creating your budget to determine how your envelopes should be labeled. To help get you started, here is a list of some general categories—only use what suits your financial needs.

- Groceries

- Entertainment (Dinners out, movies, concert tickets, etc.)

- Transportation (Gas, car insurance, public transportation fares)

- Medical Expenses

- Saving/Emergencies

- Necessities (Clothing, school supplies, etc.)

- Vacation

- Housing

- Debt Payoff

The envelope system can help new budgeters and impulsive spenders. It lets you set goals and gauge how much you spend and save. Armed with a plan, you can learn how to stick to a budget and take charge of your finances.