Back to Basics: How to manage your checking account

Think of your checking account as command central for your finances—it’s where income goes in and expenses go out. Whether you’re opening your first checking account (congratulations) or want to create better habits for managing your finances (congratulations, too), build a solid financial foundation with these 4 strategies.

1.Understand account requirements and fees

Make sure you understand any fees associated with your accounts. There could be maintenance or minimum balance requirement fees.

Avoiding overdrafts is also key to avoid fees. An overdraft is when your account doesn’t have enough funds to cover transactions such as checks, debit card purchases, and electronic funds transfers.

Typically, a bank will charge an overdraft fee when you exceed your balance, which can add up quickly. For example, if an overdraft fee is $39 for each occurrence, a shopping trip with three separate purchases could cost you more than $100 in fees.

Keep an eye on ATM fees as well. ATMs are a convenient way to access your money, but avoid fees by using ATMs owned by or affiliated with your bank. If you need to use an ATM not affiliated with your bank, you will typically be charged a fee. One option is to use the “cash back” feature at stores, which typically doesn’t charge a fee.

2.Utilize technology and other features

There’s an app for almost everything these days. But one of the most valuable ones is your banks online and mobile app. By having account access at your fingertips, it makes it easy to stay on top of your account balance real time. Plus, you can complete a variety of transactions without making a trip to the bank—pay bills, transfer money between accounts, and deposit funds using mobile deposit. In addition, it’s a good idea to consider the following:

- Set up balance and transaction alerts in online banking

- Use overdraft protection to automatically protect your account from an overdraft fee

- Automate your savings by implementing recurring transfers

- Download a budgeting app to categorize and track spending

3. Monitor your account

Traditionally, balancing or reconciling your accounts was crucial to understanding exactly how much money you had. These days technology and tools like online banking and tracking apps have helped reduce the need to balance or reconcile because you’re able to view your accounts in real time.

While balancing is a thing of the past, it’s still important to monitor and review the detailed transactions that are coming through your account. It will help you understand your finances as a whole and ensure there are no errors on your account. If you do find an error, contact your bank to report the situation.

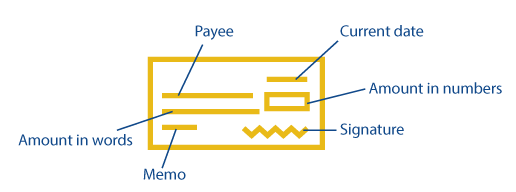

4. Know how to write a check

It may seem old fashioned, but it’s still a basic skill that you should possess. While checks have largely gone the way of flip phones and music CDs, they are still needed on occasion.

- Payee: Write out the name of the company or person you’re paying.

- Current date: This helps you keep accurate payment records.

- Amount in words: Write out the amount in words to help avoid fraud. This is actually the legal amount of the check, if it differs from the number you wrote in the box, the written words will be the value of the check.

- Amount in numbers: In the small box write the amount using numbers. (Don’t forget to add in cents after the decimal point if needed)

- Signature: Sign your name on the line in the bottom of the check. (A check will not be valid without a signature)

- Memo: While not required, writing a note helps you keep of track of why you wrote the check.

By using these four strategies, you’ll create better habits to help you successfully manage your checking and bank accounts now and in the future.