Top budgeting tips and advice from 2020

For most Americans, 2020 was a year of challenges due to COVID-19 and an uncertain economy. While there are some things you can’t control, you can control your budget. Creating a budget isn't only about tracking your expenses. It's also understanding your larger financial picture so that you can adjust your plan to meet your financial goals. We’ve collected some of this year’s top tips and solutions to help you create and stick to a budget.

Reduce expenses and financial stress during a crisis

Having a disruption in your income for any reason can be a source of fear and anxiety. The good news is you have the power to change habits and access resources to help and protect your long-term financial well-being.

- Maximize your current assets like a home equity line of credit or withdrawals from IRA or 401(k). Speak to your financial advisor before you decide.

- Do a simple audit of your bills to see what you can cut -like subscriptions or services you don’t use.

- Explore debt relief options through your bank, lender, or new government programs.

Read the full article for more tips on reducing expenses.

Should you pay down debt or save?

Paying off debt and saving money for emergencies are both necessary to achieve good financial health. If you have a limited budget, you might be wondering which one you should tackle first. Understanding the benefits of both can help you create an individualized plan for mastering your money and help you reach your financial goals.

The advantage of paying down your debt:

- You can reduce the amount of interest paid over time. This is particularly helpful if you have high-interest credit card debt.

- It can help improve your credit score.

- Once your debt is paid, you can focus fully on saving and other financial goals.

- Getting rid of debt can remove an emotional and/or mental burden.

On the other side of the equation, there are several advantages to getting a head start on saving:

- The sooner you begin, the more time you have to take advantage of compounding interest.

- You can work toward your financial goals on your own timeline, versus having to wait until your debt is repaid.

- Having some easily accessible savings can help you avoid accumulating new debt if an unexpected expense pops up.

Before you decide, find more tips on debt and saving money.

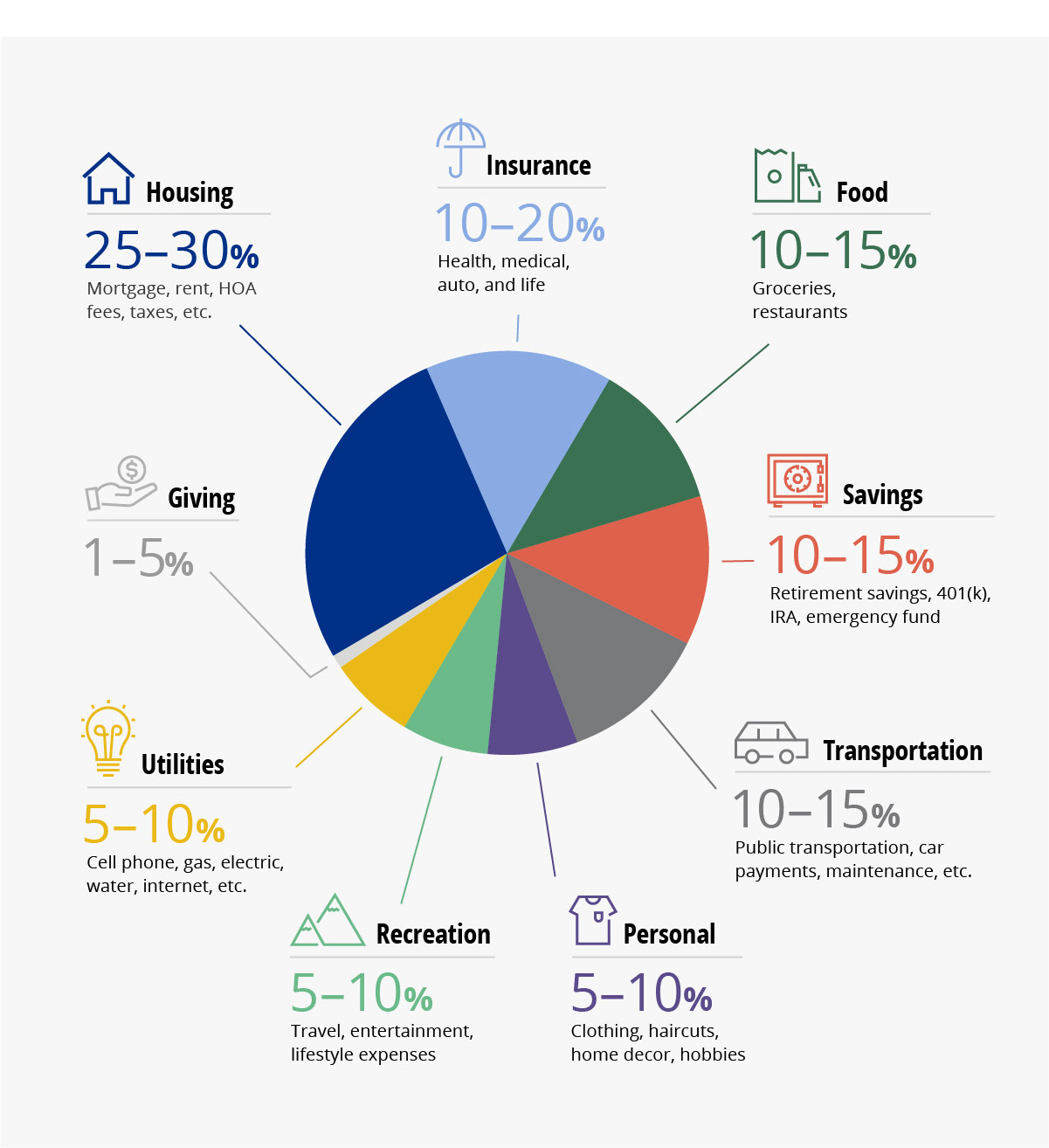

The best way to slice your budget

Creating a percentage based budget with categories can be a key way to see where you might be spending too much.

Check out this infographic to see typical expense categories and their percentages.

4 ways to boost your emergency fund

2020 taught us how critical an emergency fund can be to help weather the impact of COVID-19 or costs pay for unexpected medical or household expenses. Experts recommend that you save three to six months of living expenses for an emergency fund. Here are four ways to start an emergency fund, even if you have challenges meeting your daily expenses.

- Look for extra money (no matter how small). Any time you get extra money you weren't expecting , set it aside. This includes tax refunds, inheritances, monetary gifts from a family member, or a holiday bonus.

- Get creative with your income. Consider a part-time seasonal job, such as retail shifts during the holidays, landscaping over the summer, monetizing a hobby, or even pet sitting.

- Analyze the true joy of spending. Making purchases can give you a temporary mood boost but often our satisfaction diminishes the more we buy.

- Discover the power (and fun) of technology. Take advantage of the technology available to you like automatic withdrawals from your checking account to your emergency savings account each week or month.

Read the full article for more ideas on how to create an emergency fund .

3 steps to creating a budget

There are two basic components to a budget: your income and your expenses:

- Step 1: Add up your monthly income. That includes money you earn from your job, cash you might have coming in from a side hustle or freelance gig, and any other money you receive regularly.

- Step 2: Add up your expenses. Start with your everyday expenses, which are the ones you pay every month. That included your rent or mortgage payment, utility bills, insurance premiums, debt payments, and recurring subscriptions (Health club, streaming services, and apps.)

- Step 3: Add your fixed and variable expenses together, then subtract the total from your monthly income.

Get more details on creating (and sticking to) a budget.

As 2021 approaches, identify areas where you want to improve your budget. Even small changes can add up to keeping more money in your pocket.